Positive Pay Can Prevent Check Fraud

Positive pay is a simple but effective way to prevent check fraud

Check fraud is on the rise

In spite of the fact that overall paper check usage continues to decline each year, check fraud is on the rise due to today’s advanced technology that makes it easier than ever to create realistic counterfeit checks. Simple low-tech paper checks continue to lead as the payment type most susceptible to fraudulent attacks. Since they’re passed hand-to-hand on their way to payment, checks remain the most-often targeted payment method by those committing fraud attacks.

Check fraud also accounts for the largest dollar amount of financial loss due to fraud. Paper checks can easily be stolen, duplicated, altered, or cashed illegally. And the payer can be liable for the fraudulent checks as the liability for a bad check can quickly shift to the check issuer and away from the bank that accepts an altered deposit.

There are several situations where organizations can be prevented from seeking restitution from a bank that pays a fraudulent check, especially if the organization did not exercise “ordinary care” in issuing checks. This means an organization can’t count on a bank making them whole after accepting a fraudulent check. All of which calls for a better solution to catching fraudulent checks as they occur. One of the better ways to protect your organization from altered checks is to implement Positive Pay protection, which is available in several IBM i check printing software packages, including iChecks from inFORM Decisions.

Understanding Positive Pay

Positive pay is an automated cash-management service employed to deter check fraud. Most Commercial Banks use positive pay to match the checks a company issues with those it presents for payment. Any check considered suspect is sent back to the issuer for examination. The system acts as a form of insurance for a company against fraud, losses, and other liabilities. There is generally a charge incurred for using it, although some banks now offer the service for free. It protects against altered, forged, and counterfeit checks by verifying the accuracy of a check’s account number, date, and dollar amount when the check is presented for payment.

How it Works

Positive pay is a simple but effective way to prevent check fraud. It stops criminals from cashing fraudulent checks using stolen account numbers. It also catches bad checks where the check amount has been altered or the check has an invalid date.

- Bank customers send a check register file containing check numbers, dates, and amounts to their bank for checks the customer has written.

- When a check is presented for payment, the bank compares the presented check against the customer’s previously transmitted check information for that account.

- The service matches the check number, dollar amount, and account number of each check against a list provided by the company. In some cases the payee may also be included on the list.

- Where there’s a discrepancy between a presented check and check file information, the check will not be cleared. The bank notifies their customer through an exceptions report and withholds payment until the customer tells the bank to accept or reject the check.

Payee Positive Pay

Payee Positive Pay offers even a higher level of fraud protection than traditional Positive Pay. Traditional Positive Pay only includes comparing check numbers, dates, and amounts. It does not include payee verification, to insure the payee name has not been altered. Many banks provide Payee Positive Pay as an added feature to Positive Pay, and that may include additional fees. If you choose payee verification, make sure that your software and your bank both support it. iChecks from inFORM Decisions supports Payee Positive Pay

Transmission File

There are several different transmission methods and formats in which check data can be submitted to a bank. Not all banks use the same transmission format and transfer protocol. And some banks use different formats in different divisions. If your organization is planning Positive Pay, you may have to account for several different check file formats. If you’re implementing Positive Pay on an IBM i contact inFORM Decisions for a check writing package that enables you to produce the correct format for your bank. The file can then be submitted using a variety of transmission protocols such as FTP and sFTP.

Benefits

Although using Positive Pay requires a few extra steps, the advantages for your business are well worth the effort. Consider the many benefits, which include: Lower costs. By significantly reducing the potential for check fraud, Positive Pay can save you time, effort and real dollars.

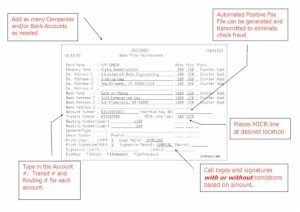

When checks are printed with iChecks/Positive Pay Software, the process becomes simple. A file containing information such as check number, date, amount, and payee is automatically sent to your bank. When a check is presented at the bank for payment, the bank reviews the positive pay file to see if the check is valid. Funds are released only when the payment details match the exact items on the check file. Check fraud prevention is easy with inFORM Decisions.

Call (800) 858-5544 / (949) 709-5838 or visit us at www.informdecisions.com for more information about Positive Pay or our acclaimed iDocs suite of IBM i products.